03 Nov Chart of Accounts, Income Statement, and Balance Sheet

Chart of Accounts

A chart of accounts is a master list of all of the account names that a company has identified for recording their financial transactions in their general ledger. A general ledger is the portion of the accounting system that contains the balance sheet and income statement and where transactions are recorded. This list will contain account titles that are customized to the particular company and industry. For example if a company is a baker then they will have line items that relate to their industry such as flour, yeast, sugar, butter and to-go boxes. Other businesses like an auto mechanic might have line items like tires, batteries, spark plugs, oil and shop towels etc. Within each of the categories you can have subcategories where the business can organize their departments (manufacturing, sales, marketing, administrative, finance). Separating each department will allow the owners to evaluate each department’s income and expenses and compare them to the corporate budget. For example, each department might be tracking their phone, salaries, travel expenses, supplies or photo copy expenses separately. It allows for further review of company departmental managers and review how well each department is managed.

Accounting software packages such as QuickBooks, often come with a sample chart of accounts for a variety of businesses. This is simply a starting point for a company. They are expected to modify these initial samples in order to meet the specific needs of the individual company.

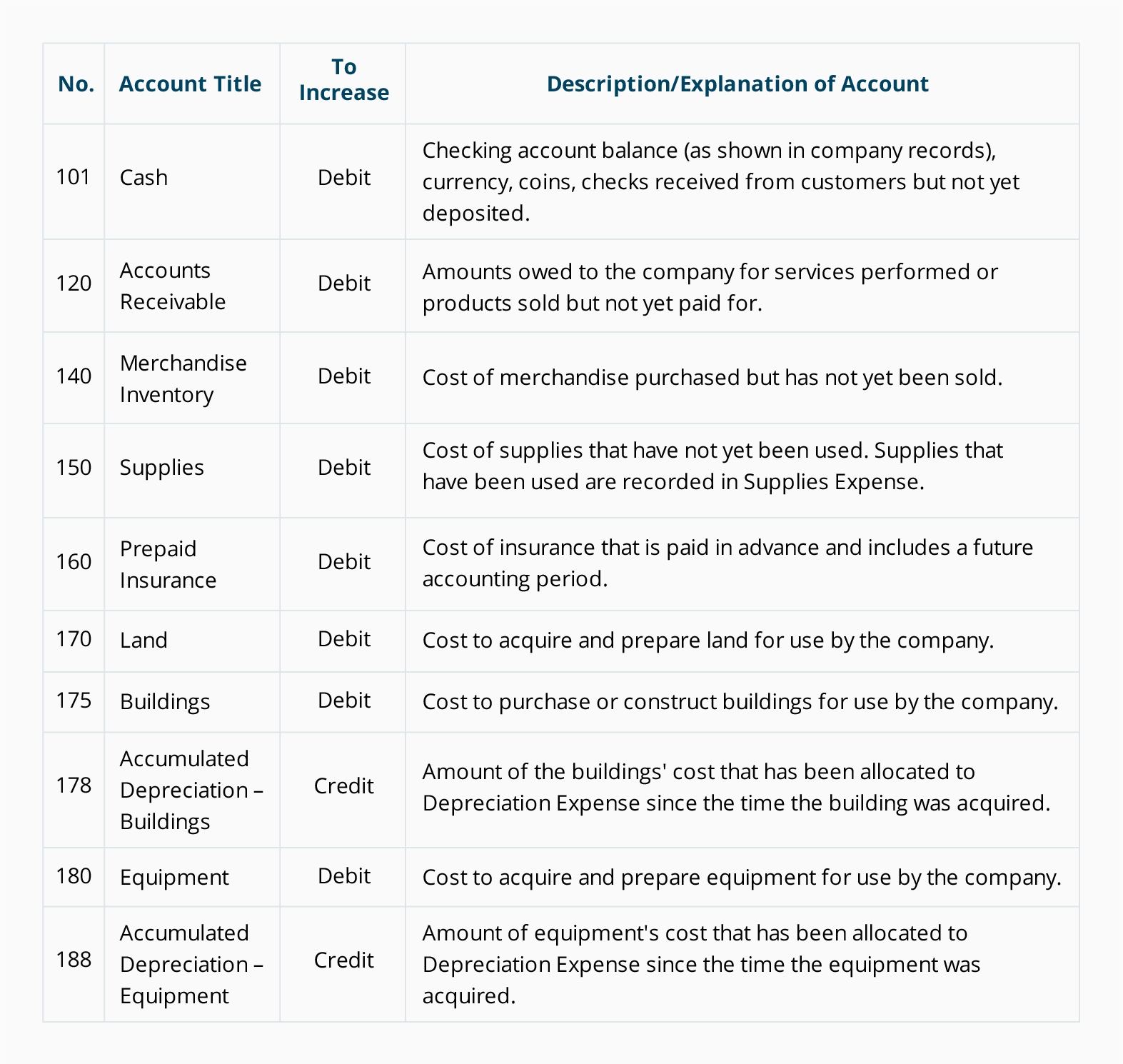

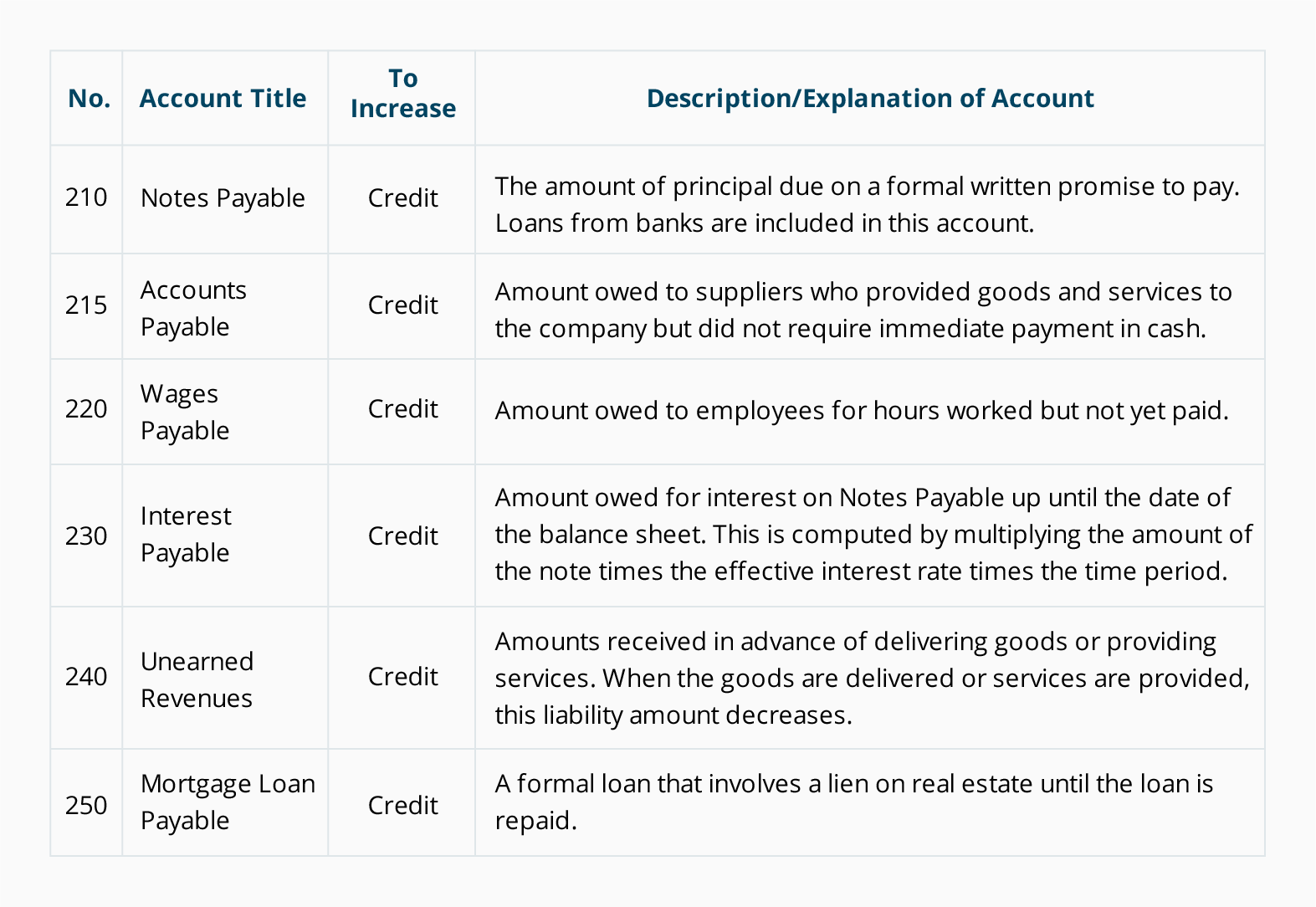

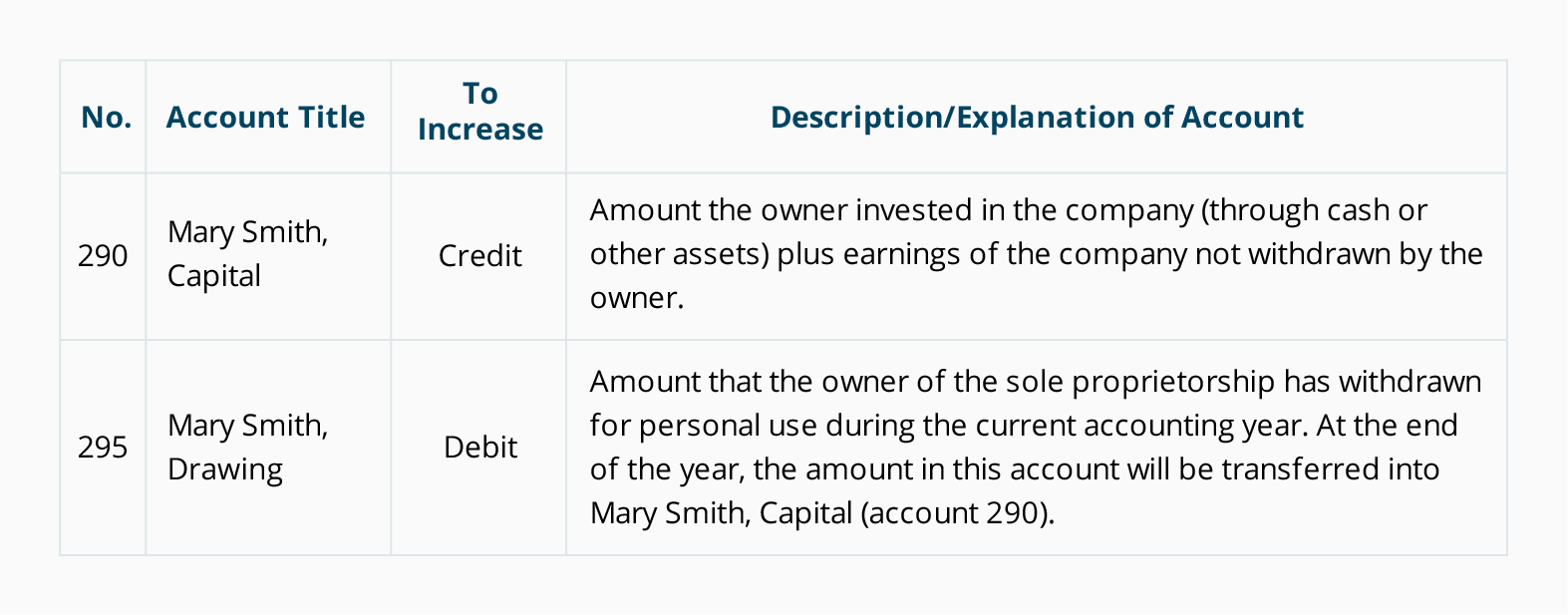

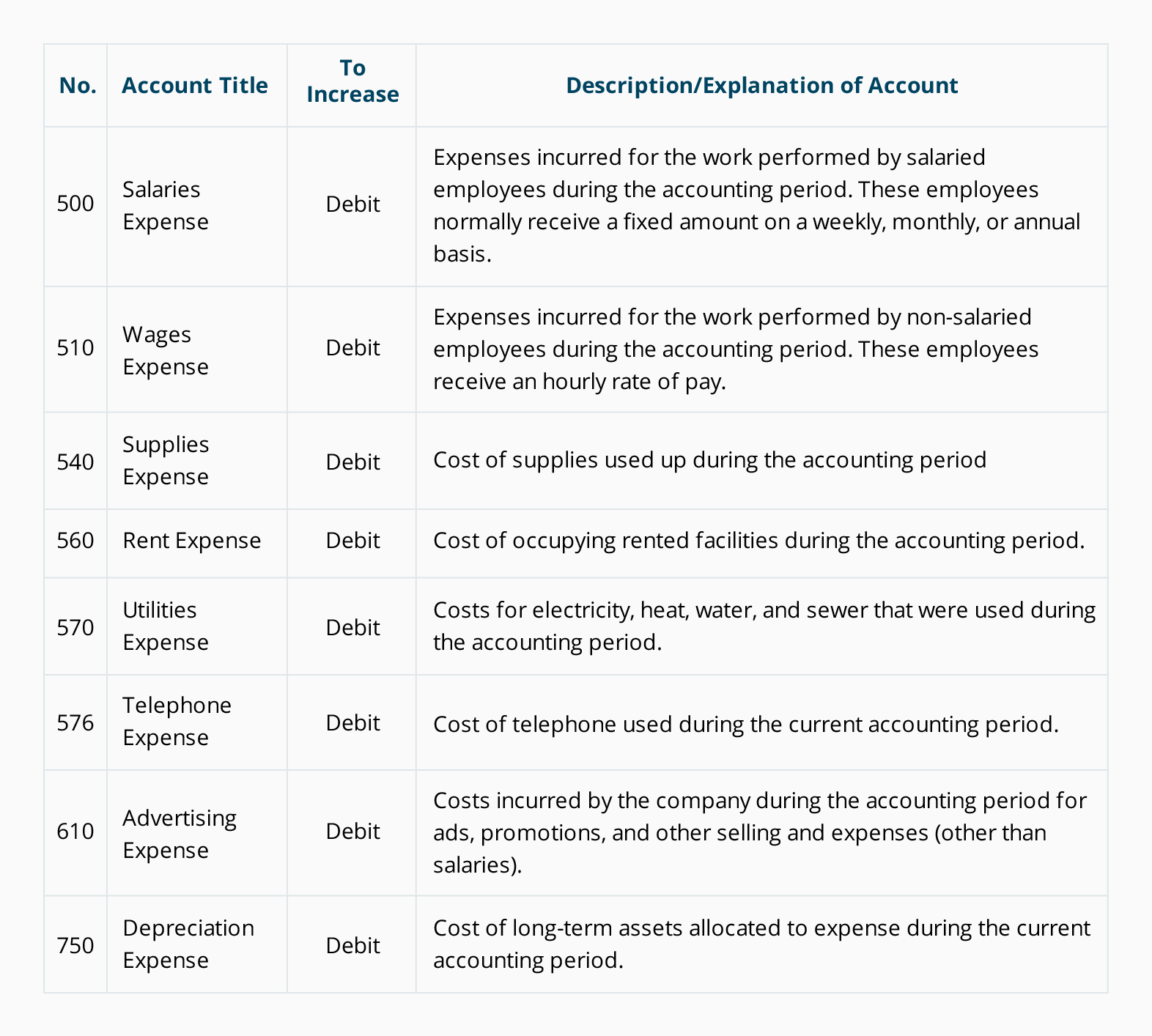

Below I have shared a sample chart of accounts for a small company. The first digit of each of the account numbers signifies the type of account it is. For example, any accounts starting with a “1” are an asset accounts.

Sample Chart of Accounts

Assets

Liabilities

Owner’s Equity

Revenue Accounts

Expense Accounts:

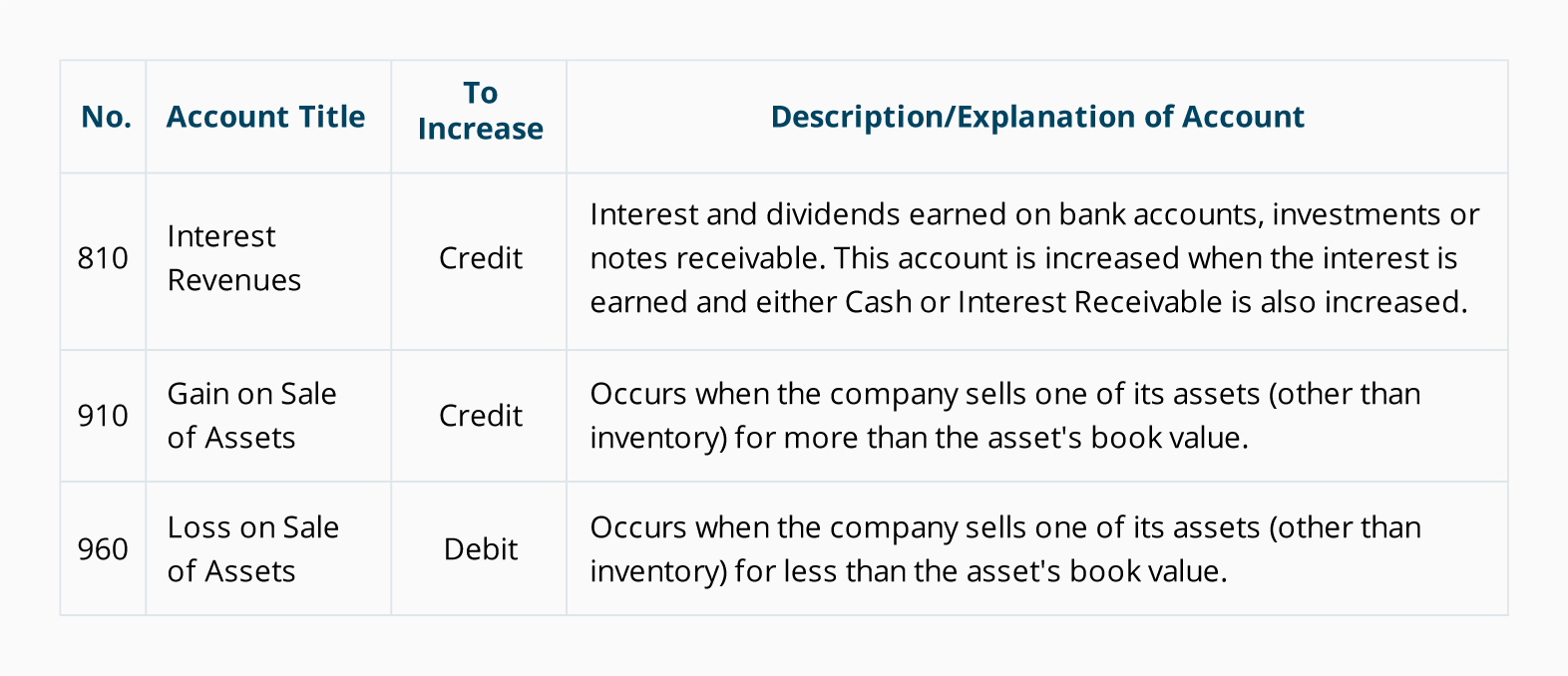

Non-Operating Revenues and Expenses, Gains, and Losses

Income Statement

The income statement is one of the four primary financial statements which is used by the owners as well as their accountants/controllers/CFOs etc. This list includes

- Balance sheet

- Income statement

- Statement of cash flow

- Statement of stockholder’s equity

The income statement is also known as the profit or loss statement, statement of operations or the P&L statement. This statement is important because it tracks the profitability of a company through a specific period of time. Many of the accounting software applications, like QuickBooks or Peachtree, allow you to change and adjust this time period at will. The most common reports are printed or reviewed monthly, quarterly and yearly. The complexity of the income statement will reflect the company’s industry, size and complexity of their business dealings.

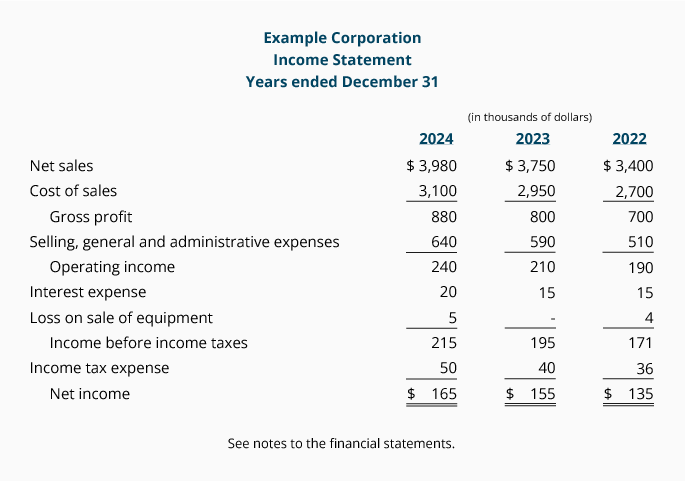

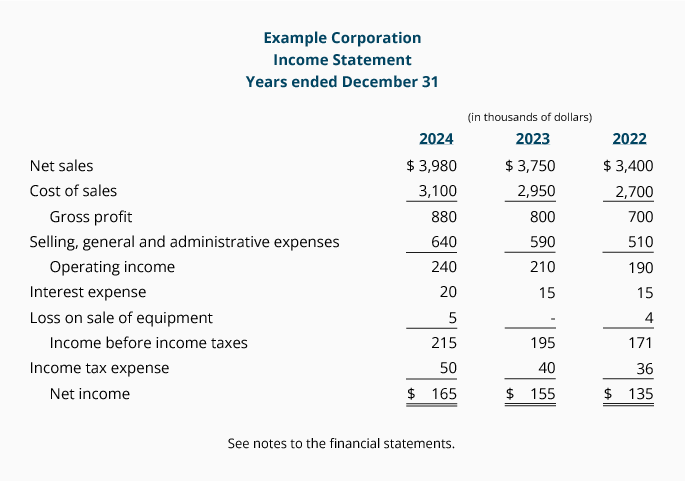

There are two commonly used formats for the income statement. The single-step format uses only one subtraction to calculate a net income. The multiple-step format allows for multiple subtractions in calculating the net income. Please note that in both formats the resulting net income has not changed. The reports are simply formatted in different ways to put emphasis on different steps in the accounting process.

Sample Single-Step Income Statement

Sample Multiple-Step Income Statement

Balance Sheet

The balance sheet, also referred to as the statement of financial position, is one of the four primary financial statements which is used by the owners as well as their accountants/controllers/CFOs etc. This list includes

- Balance sheet

- Income statement

- Statement of cash flow

- Statement of stockholder’s equity

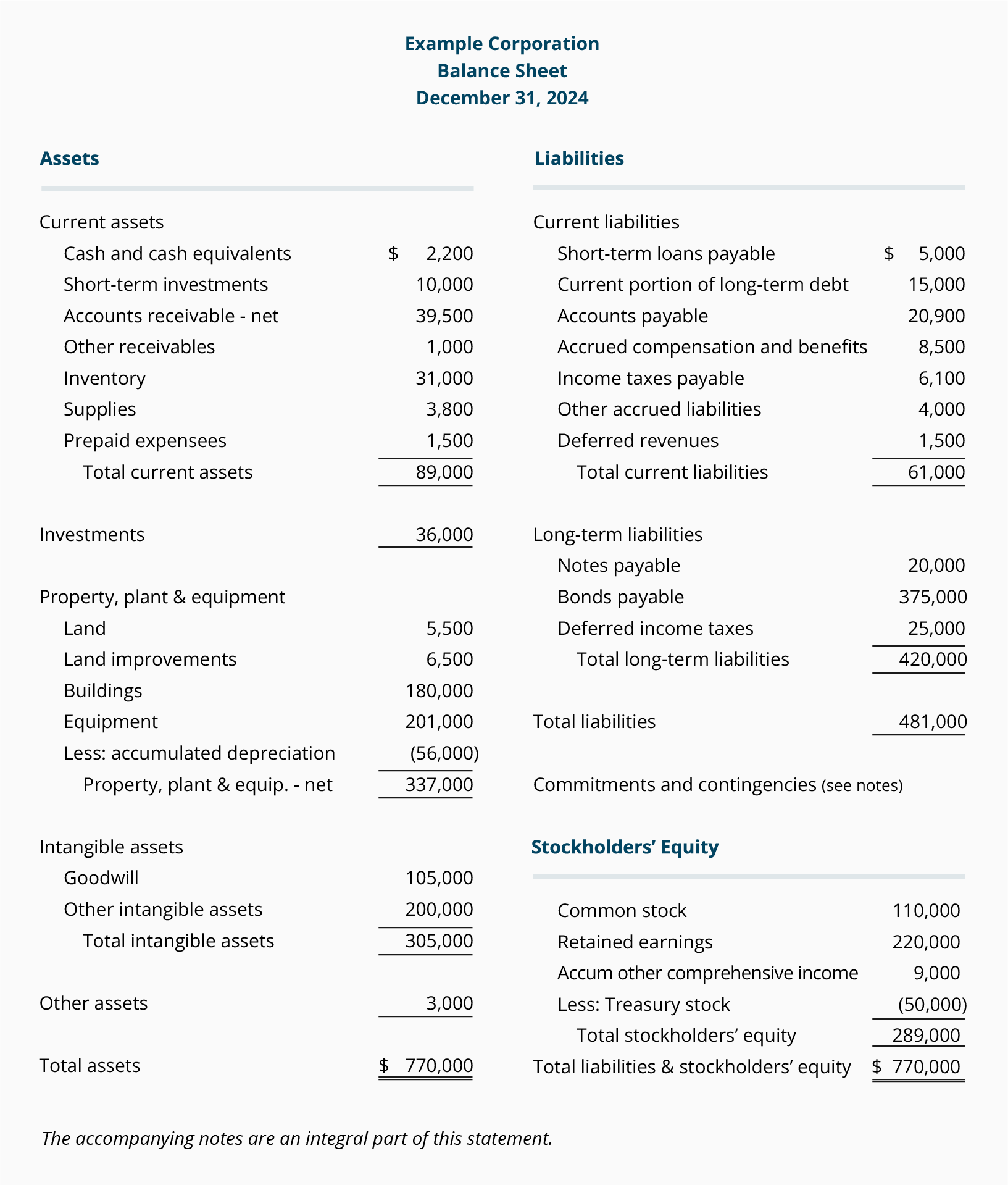

The balance sheet represents a company’s financial situation at the end of a specific date in time. It is often times referred to as a “snapshot” or a “moment in time” picture of a company’s financial position. A balance sheet is comprised of their assets (items of financial value), their liabilities (items that reflect a debt owed) and stockholder’s or owners’ equity (book value of the company). The most common reports are printed or reviewed monthly, quarterly and yearly. The complexity of the balance sheet will reflect the company’s industry, size and complexity of their business dealings.

Assets are considered “current” if they are believed to become cash within one year of the balance sheet date. Liabilities are considered “current” if they are due to be paid within one year of the balance sheet date.

Sample Balance Sheet

Resources:

http://www.accountingcoach.com/chart-of-accounts/explanation/2

http://www.accountingcoach.com/income-statement/explanation/1

http://www.accountingcoach.com/balance-sheet/explanation/4

American Institute of Certified Public Accountants (AICPA) Financial Reporting Framework for Small- and Medium-Sized Entities with Implementation Resources

Quickbooks Accounting Software

Small Business Association Financial Statements

http://www.sba.gov/content/financial-statements

http://www.sba.gov/blogs/3-essential-financial-statements-your-small-business

Small Business Association Resource Guide

http://www.sba.gov/sites/default/files/files/resourceguide_3127.pdf

No Comments