25 Jul Entrepreneurs guide to Understanding Financial Statements Class

Because I am a Certified Public Accountant that specializes in Small Business and Solo-Entrepreneurs in Western North Carolina, I meet a lot of people who are starting a new business. Every entrepreneur has that special internal fire, passion, and unique to their business knowledge but not all of them are skilled in understanding the numbers side of their business. Most specifically, reading their Financial Statements and their businesses Cash Flow.

On July 22nd, I lead a presentation and discussion at the Western Women’s Business Center. Sharon Oxendine, Western Women’s Business Center Director invited me to attend. We had a total of 12 women RSVP for the event held at the Lenoir- Rhyne University’s Center for Graduate Studies in Asheville. The attendees came with a variety of backgrounds to include catering, communications, social media consulting, health and wellness to name a few.

During the robust discussion the attendees discussed the challenges, they faced during of the early stages of their business’ life cycle. They felt that their top challenges included of marketing their new business on a small budget, finding venue space within their budgets, and understanding the financial statements and tax requirements. We discussed the benefits of establishing their business as a separate corporation, what the corporation options are in North Carolina, and how to become a corporation. During the discussion, I shared the pros and cons of the different business forms (sole proprietor, partnership, LLC, C Corp and S Corp) as well as how they impacted their individual tax returns.

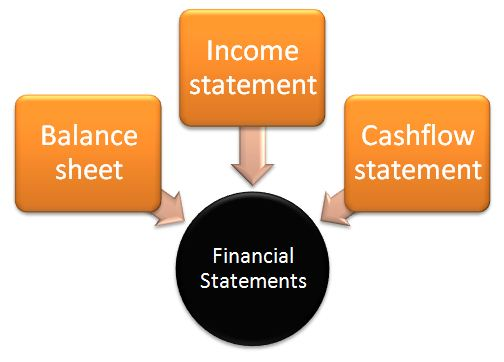

Another focus of their class was on Understanding Cash Flow and their Financial Statements. As their business grows, they will often be in positions to entice investors or request a loan. All of those discussions with outside companies will include a need for compiling and understand their company’s financial statement. Understanding the numbers side of any business is crucial as it will not only tell you how you are doing this year vs. last year, but it will also help you see how your business is doing in comparison with others in your industry or market.

For more information on Understanding Financial Statements, Cash Flow and Business Organizational Options, please feel free to email Alicia Sisk-Morris at asmcpa@yahoo.com or to call me at 828-645-2000 to set up an appointment. The Western Women’s Business Center offers free monthly classes. To attend future events, please contact Sharon Oxendine at the Western Women’s Business Center 828-785-1504 or via email soxendine@thesupportcenter-nc.org.

No Comments