01 Jun Three ways to structure your business investments

As a woman Certified Public Accountant located in Weaverville, NC, situated in the greater Asheville, NC market, it is very common for me to interface with start-up companies. Some companies are set up to be one woman or man operation while others are more complex in nature. During this blog, I will review three fundamental structures a company can take and how that will affect your goals of attracting Angel Investors. These structures are laid out in the book “Winning Angels the 7 fundamentals of early stage investing” written by David Amis and Howard Stevenson there are five approaches to valuation.

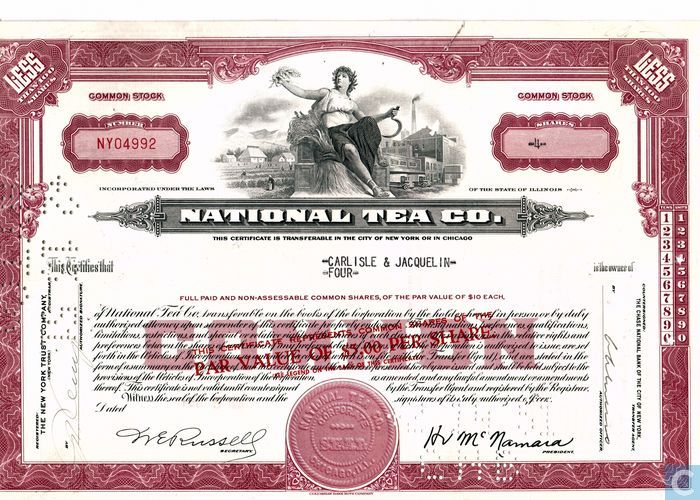

“The rule is that you use preferred (stock) to attract capital and you use common (stock)to attract staff” Tony Morris

Common Stock:

Common stock provides evidence of ownership in a corporation. Owners of common stock elect the company’s directors and share in the profits of the company through stock dividends. If a business closes, the common stock holders are the last to be paid.

The issuance of common stock is the form that is most often used by friends, family and those with “blind” faith in the owners of the business. This structure is the most simple to set up and operate. The offering agreement can be configured very quickly, and it offers no limits on the company regarding restrictions on raising further capital or on the funds terms. There is no downside protection on this structure. Worst case scenarios are you lose all of your money, and the best case scenario is you make a lot of money with little involvement and limited time investment.

Preferred Convertible Stock:

Preferred stockholders are paid dividends before the common stockholders receive any dividends. They usually receive a fixed dividend rate and do not share in the company’s earnings above their fixed dividend.

This is the most common structure used by venture capitalists and angel investors. The agreements can range from 5 terms up to 40 terms depending on the investor. Standard conditions include information rights, board rights, anti-dissolution, redemption rights, per-emptive rights, and tag-along rights. Worst case scenario is you lose all your money and best case you make a lot of money, including additional rounds, and you feel somewhat secure about it.

Convertible Note (or bond) with Various Terms:

According accountingcoach.com, The holder can exchange a convertible bond (long term note) for a specified number of shares of stock in the company. The convertibility feature usually allows for the bond to have a lower interest rate. The owner of the bond enjoys the ability to watch the stock prices and take advantage of the gain if the stock price increases.

The convertible note is becoming a more common vehicle as financing is occurring in a shorter time frame. This format avoids a negotiation on price, and it limits options pricing issue for the company. Having a note is the most powerful downside protection you can have. The upside often includes the right to participate in subsequent funding rounds with various addendum.

Other Blog Posts of interest:

Methods Investors Use to Evaluate Companies

Schree Chavdarov

Posted at 18:51h, 01 JuneIt’s always a pleasure reading your blog because I love to uplift my fellow female entrepreneurs. Did you use any particular method when constructing your business investments? I noticed that the best and worst scenarios for each investment are similar – you gain money or you lose money.

asmcpa@yahoo.com

Posted at 00:17h, 04 JuneI appreciate the feedback and support from a fellow female entrepreneur. I think we are an up and coming group of business people bringing our brand to the market. My business is 100% funded by me. Not too many VC are interested in CPA firms as I don’t produce a physical product. My work is more service driven. Other ideas I have may bring forth investments from outside. Thanks for your thoughts and feedback.

Alicia

Will Hager

Posted at 20:21h, 07 JuneI really like how you gave an overview of the three structures. Again coming from an MBA program my knowledge about these terms and concepts is minimal. I now have a better understanding and grasp on each of the three terms. In the start up companies that you have worked with have you seen a method which is more successful than the other two? I know in the above comment that you do not utilize any of these methods, however, if you started a new venture that required one of the three, which you would go for? Great Post!!! Very Informative!!!

asmcpa@yahoo.com

Posted at 20:33h, 07 JuneWill,

Good question. As a solo-entrepreneur / single person LLC I am basically bankrolling my own company from the ground up. This is quite common in the accounting industry as there are quite a few laws and regulations as it relates to how CPAs are structured and how they operate. Now, if I were to become involved in a company that was outside of the accounting industry, say a company selling a product, I would then have to think about what kind of relationship I would want with the investor. Is this someone I want to do long term business with or are they a silent partner who just wants some ROI. That decision would impact which form of investment I would consider offering. My end goal would be a win-win situation.

Alicia

Maria-Elena Surprenant

Posted at 02:36h, 11 JuneThe break down of these three structure types was very reader friendly. It never really phased me that there were such things as “structure types”, but I am thankful for this angel investor novel that has educated me on such things. I know your financial background is to your advantage in this course!

asmcpa@yahoo.com

Posted at 14:58h, 11 JuneSo glad you found this reader friendly!

Alicia

Chris Sitzman

Posted at 17:44h, 20 JuneNice breakdown on ways to structure a business investment. If a business fails do the preferred stockholders divide up what is left and if anything is leftover after that then the common stockholders get paid?

asmcpa@yahoo.com

Posted at 17:35h, 22 JuneChris,

There is certainly an order to which payoff occurs. The Preferred stockholders do get their money before the common stockholders. However, there are often times many others who get their money before the preferred stockholders. For example, if there is a loan on a building then the building is the collateral for the loan. In that case the building would go to the mortgage company as they held the lien.

Mitch McDowell

Posted at 15:00h, 22 JuneAlicia,

Good article as usual. I think that the 3-F investors (family, friends, and fools) might do well to consider asking for Preferred Stock when investing in these projects. This could be an important detail if they are putting up a significant amount of funding for the project.

Mitch

Chris Carter

Posted at 23:54h, 28 JuneAlicia,

As usual, you presented the information from this section of the book in a clear and concise faction. After reading what you wrote, I have a better understanding of the differences between these three types of funding.

Chris

asmcpa@yahoo.com

Posted at 01:58h, 02 JulyI am glad you found it helpful!

Alicia